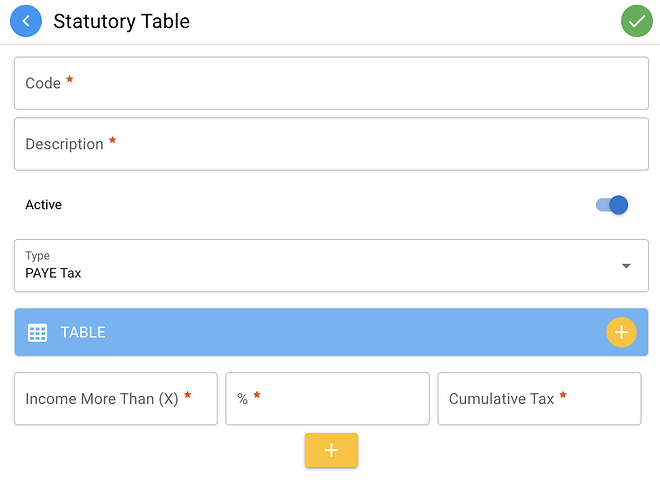

This is to serve as the user guide for Statutory Table module.

I will add more content to it from time to time.

In the meantime, just reply to this post if you have any question about Statutory Table.

Note: Presently only PAYE Table is supported. If you need the support for other kind of statutory table, do let me know.

Cumulative Tax: Total payable tax amount before current tier of income bracket.

Adjust the income brackets, rates and cumulative taxes to match your payroll cycle. E.g. if the PAYE table is based on yearly income, then you may divide the values by 12 for the purpose of Monthly payroll cycle.

Here are some examples of how to enter your Pay As You Earn (PAYE) or Pay As You Go (PAYG) tax schedule into Statutory Table.

Example 1 - Monthly Income Bracket:

0% (0 up to- 80)

4% (80 up to- 250)

8% (250 up to- 450)

10% (450 and up)

Enter it according to the following format:

Income More than (X) | % | Cumulative Tax

=======================================================

80 | 4 | 0

250 | 8 | 6.8

450 | 10 | 22.8

If salary is 500 per month, then the tax will be:

250 - 80 = 170 * 4% = 6.8

450 - 250 = 200 * 8% = 16

500 - 450 = 40 * 10% = 5

Total tax is : 6.8 + 16 + 5 = 27.8

And you will get the correct result if you set up the Statutory Table correctly.

Example 2 - Monthly P.A.Y.E for Ghana:

Enter it according to the following format:

Income More than (X) | % | Cumulative Tax

=======================================================

365 | 5 | 0

475 | 10 | 5.5

605 | 17.5 | 18.5

3605 | 25 | 543.5

20000 | 30 | 4642.25

Your will be able to match the calculation results in the post quoted.