This software is amazing. i was wondering if anything can be done about this. In y country the payroll is a bit different and I would like to know if anything can be done to resolve this.

Lets say Employee (M) makes Gross salary of $130000 gyd. In my country there is a Insurance Contribution of 5.6% by employee and 8.4% by employer (Employer not deducted from gross).

Then there is taxes calculated on the remainder after a threshold of $100000 has been met. So for example the calculations will be:

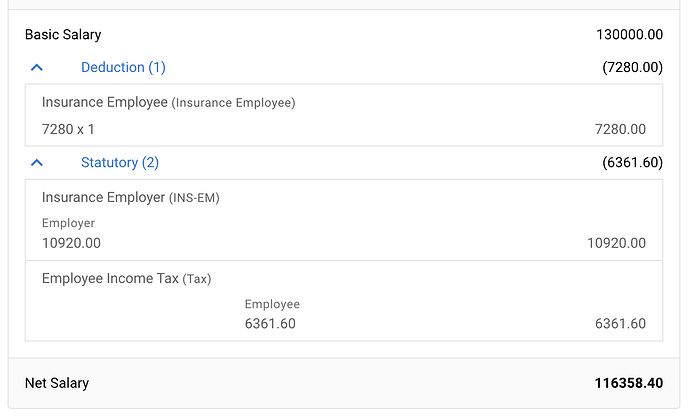

Gross salary $130000

Insurence Employee (@5.6% Gross)=$7280

Insurance Employer (@8.4% Gross)=$10920

Chargable income= (Gross- Employee Insurance [$7280])- (Threshold[$100000])=$22720

Taxes will be 28% of chargable income which would be iqual to $6361.

Balance=22720-6361=16359

Net salary= $100000+16359 = $116359.

How can i get this using your software.

i keep having issues reaching this total

Thank you

For now, you may

- Use Deduction to handle Insurance Employee.

- Use Statutory Contribution to add Insurance Employer.

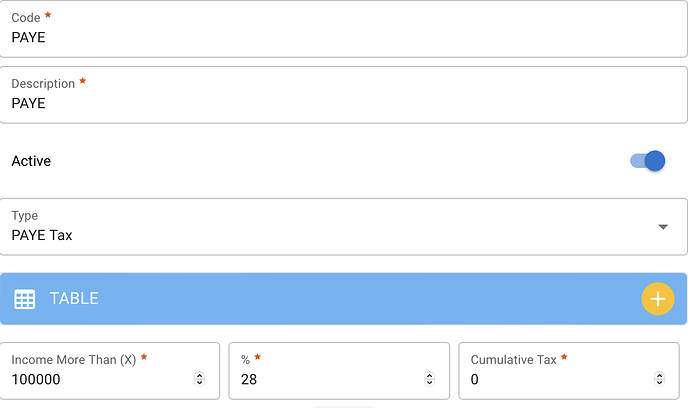

- Add a Statutory Table with taxable amount above 100000, for 28% tax rate, and 0 cumulative amount.

The result is like this:

This means the for each employee, we will need to manually add each individuals insurance as a figure vs using the calculator @5.6% correct?

Also same would apply for the income tax correct?

Is there anyway to have in the deductions a percent calculator were we can create a format @5.6% gross so when we add the statutory table it only calculates the 28% based on the remainder vs putting exact figure in hte deductions?

-

For deduction, yes. Deduction by percentage is already planned, but I have no time to implement yet: HR.my Upcoming Features Todo List check item 11.

-

For Tax, no. It’s auto calculated as long as you set up correctly.

Good morning

hope that you are well.

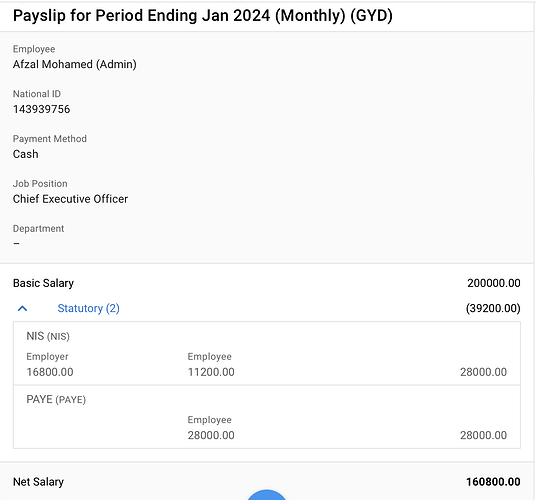

just a question; I have a template of what comes out … Gross salary of $200000 thre nis is correct and the PAYE is done through a statutory table as shown in the second pic. the problem is that after the $11200 (NIS) and $100000 (Tax Threshold) are removed from the gross the balance is $88,800 and 28% of that is $24864. but I get $28000 on the software. Any advice?

Can you show me your Statutory Table setup?

Also, let me know what result you expected instead?

the calculations I get work out to more than 28%

in the above example, the gross is $200000

The Insurance (NIS) is perfectly calculated in the app with 8.4% as the employer and 5.6% as the employee. However the table has a chargable of more than $100000 @28% therefore the chargable is $88800 @28% which is $24864. but the $28000 works out to being 31%

Thanks

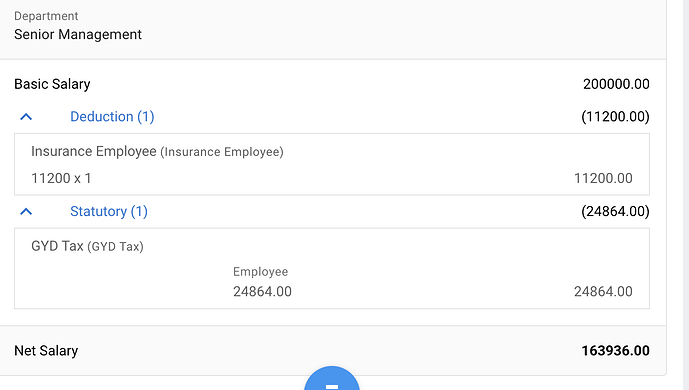

I have checked your calculations, you have missed a very important point from my previous reply:

-

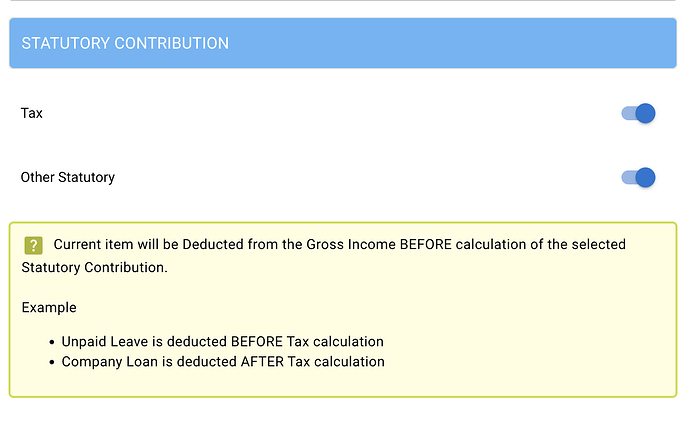

Note that since the Employee Insurance needs to be deducted from Gross Salary before calculating for Tax, you cannot use Statutory Contribution for Employee Insurance. You should use Deduction to handle Employee Insurance instead.

-

In the mean time, Employer Insurance should be handled with Statutory Contribution.

This way, your Tax calculation will show the correct result after deducting Employee Insurance from Gross Salary.

Hello,

Ill do the same and let you know… i was trying to run from the fact that i have to individually add the amount for the insurance which is 5.6% of the gross for each employee as opposed to creating it as a fixed 5.6% and the calculation is automatically done…

Thanks for the advice. …

Sorry for the inconvenience caused. I will enhance Deduction to support variable amount by percentage of Gross Salary later.

Did it and got the same outcome ill send screenshots.

I do not know what im doing wrong…

i get the same result…

Have you checked the Other Statutory option in Deduction? This is to make sure that the Deduction is processed before calculating Other Statutory, i.e. your PAYE.

still the same… ill reset all the tables and try again…

thanks

Please check your data carefully, as I have already shown you, my result is correct.

Hello,

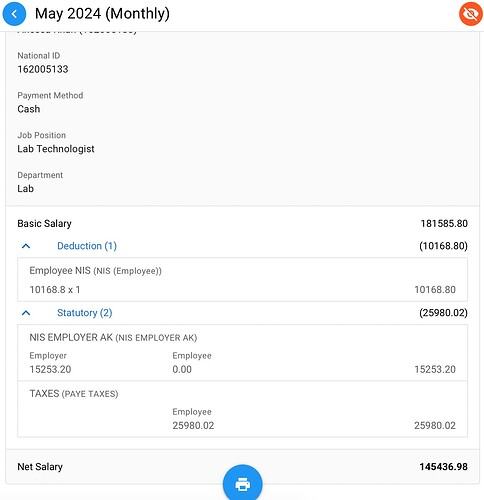

So i created an employee, as you can see in the image i am getting a different calculation in the statutory table. I don’t understand. The Taxes is where the issue lies, the rule in my country is that if after the deduction of NIS for employee and the remaining salary is >$100000, then 28% is deducted from the amount over $100000.

So in this example, her Gross is $181585.8, Her deduction is 10168.8, bringing her remaining salary to $171,417. From this the treshold is $100000 so her chargablke income is 171417-100000=71417. Then we use the 28% against the $71417 and that gives us 71417*28%=$19996

Now her Net will be $100000+(71417-19996=51421)=$151420. Please Advise why i am getting 145436 instead. i have done the tables again and again.

Have you checked this? Please understand that I really don’t have time to provide handholding guide. From my example, I could already get the correct result, and provided you ALL THE INFO that I used for such calculation. You may want to check the entire post and replies again.

Ok thank you, i understnd. can you please add the last set of figures i sent you at your end and send me a pic of results and your statutory table used please .

thank you ,

Your last set of figures do not matter at all. Just look at your deduction, it’s already different from mine.

ok. thanks.