This software is amazing. i was wondering if anything can be done about this. In y country the payroll is a bit different and I would like to know if anything can be done to resolve this.

Lets say Employee (M) makes Gross salary of $130000 gyd. In my country there is a Insurance Contribution of 5.6% by employee and 8.4% by employer (Employer not deducted from gross).

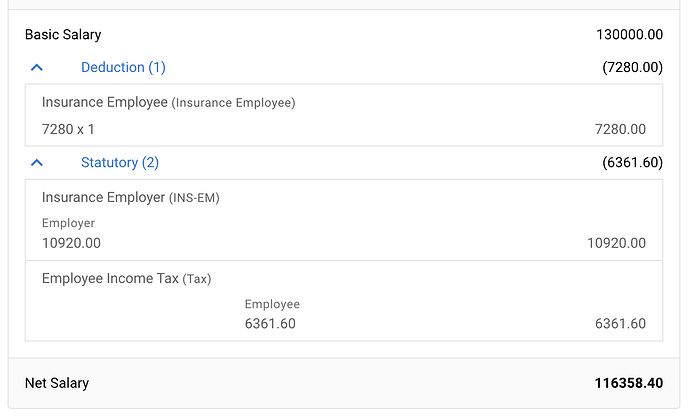

Then there is taxes calculated on the remainder after a threshold of $100000 has been met. So for example the calculations will be:

Gross salary $130000

Insurence Employee (@5.6% Gross)=$7280

Insurance Employer (@8.4% Gross)=$10920

Chargable income= (Gross- Employee Insurance [$7280])- (Threshold[$100000])=$22720

Taxes will be 28% of chargable income which would be iqual to $6361.

Balance=22720-6361=16359

Net salary= $100000+16359 = $116359.

How can i get this using your software.

i keep having issues reaching this total

Thank you

For now, you may

- Use Deduction to handle Insurance Employee.

- Use Statutory Contribution to add Insurance Employer.

- Add a Statutory Table with taxable amount above 100000, for 28% tax rate, and 0 cumulative amount.

The result is like this:

This means the for each employee, we will need to manually add each individuals insurance as a figure vs using the calculator @5.6% correct?

Also same would apply for the income tax correct?

Is there anyway to have in the deductions a percent calculator were we can create a format @5.6% gross so when we add the statutory table it only calculates the 28% based on the remainder vs putting exact figure in hte deductions?

-

For deduction, yes. Deduction by percentage is already planned, but I have no time to implement yet: HR.my Upcoming Features Todo List check item 11.

-

For Tax, no. It’s auto calculated as long as you set up correctly.