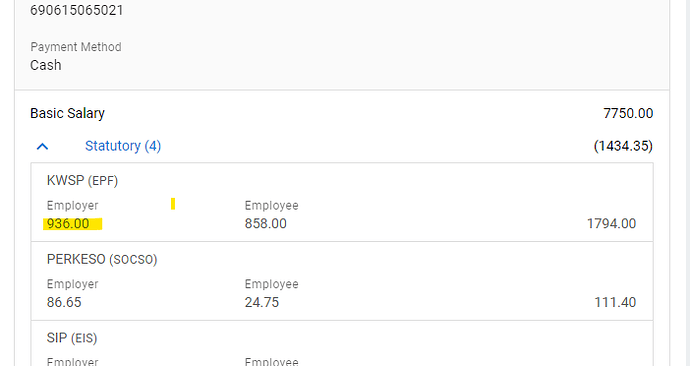

Why is employer contribution coming up to be 12.077 % instead of 12%?

There is a rounding requirement. If you don’t like this calculation, you may override the calculation with yours: Malaysian Statutory Contribution, PCB, EPF, SOCSO, EIS, HRDF, KWSP, PERKESO, SIP, PSMB :: Free Payroll

I think it is a simple calculation: RM7750 x 12% = RM930

Why is the system complicating it? All the other calculations are correct except for employer EPF contribution.

Also only happening to this employee. Others are correct.

OK I think I know why. It is referring to range 7,700 - 7,800n according to Third Schedule EPF Act.

1 Like