Is it possible to give another option to basic salary instead of deducting statutory contribution from total salary, because many organizations do not deduct funds from total salary, they deduct specific funds from basic salary , even in my company I could not generate payroll for employee , Because deducting a certain amount of portion on this gross income, I hope you will look into the matter, if it was possible, then we would have been able to take sponsorship.

-

Can you tell me your use case?

-

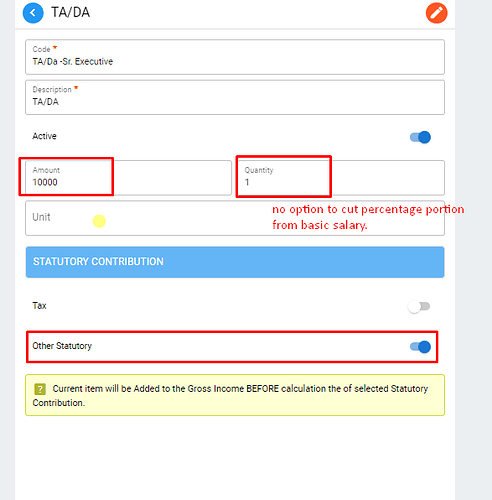

Have you unchecked the relevant Earnings’ Statutory option? This will exclude the additional Earnings from being used for Statutory Contribution calculation.

Let employee Total Salary is 30000$

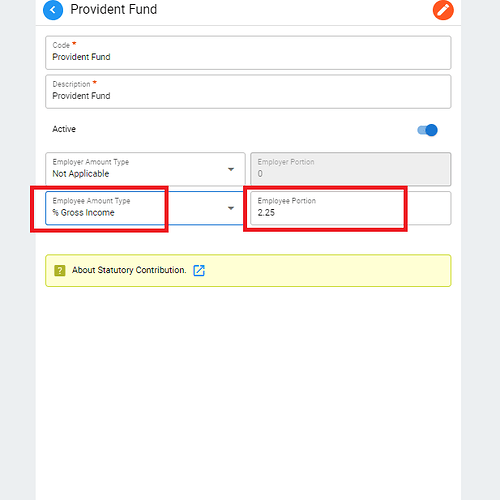

Then we cut statutory contribution from employee salary 2.5% of Basic salary of each and every employee.

Basic Salary =30000*2.5%=750$,

Now we cut this 2.5% as a statutory contribution of employee.

then the basic salary is 29250$, then add food allowance , travel allowance, and many other things .

as like as,

Basic salary after statutory contribution 2.5% is 29250$

then add food allowance 200$,

Travel allowance 300$

then the total gross salary is 29250+200+300=29750$.

iam from bangladesh, in bangladesh labour law, deduction statutory contribution from basic salary, not from gross income…Thank you kap chew for early reply, hopefully we get a solution for this Problem.

yes i checked other relevent things from earning section, there was no option to deduct a certain portion from employee basic salary…

If you uncheck the Statutory option in Earnings, it will not be included in the total income for Statutory Deduction, have you tried it?

e.g. food allowance and travel allowance, these 2 earnings should be set to exclude Statutory in Payroll->Earnings->Edit

yes i tried each and every possible way to cut a percentage amount from basic salary , there was no option in your HR.my to cut contribution from basic, not from gross…

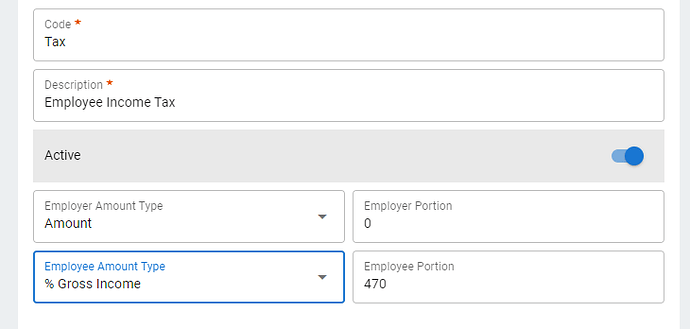

Here is statutory contribution no option to cut from basic, only available option is gross income only…

Uncheck Other Statutory.

i dont find out any option, i said the problem was ,if i deduct statutory contribution, it cut the percentage , from gross salary, but is it possible to cut the amount from basic salary ? i tried all way but its not possible into your system…

I already told you the solution, but somehow you keep going back to the question without even trying to understand what I said.

I am closing this topic as I have told you whatever you need to do, and your case is already handled in the solution above.